Five Challenges to Closing the Digital Divide and How to Solve Them

Challenge #1: Equipment and material shortages Today's broadband equipment was built for yesterday's approach to building fiber networks. As a...

2 min read

.png) Jan Moeremans

:

Jun 27, 2023 12:44:31 PM

Jan Moeremans

:

Jun 27, 2023 12:44:31 PM

Traditionally, AltNets relied on the Total Homes Passed (THP) or UPRNS to indicate progress and success. However, with interest rates rising globally, some investors are now prioritising shorter-term financial KPIs and market monetisation, with their focus shifted to a more meaningful metric: homes activated. This blog post explores the importance of homes activated to accurately indicate network success and its significance for investors and the telecommunications industry.

When evaluating a network's performance and revenue potential, relying on more than the number of homes passed is essential. Historically, AltNets scale and value was quoted in terms of reaching impressive household passed milestones. However, the actual rate of adoption by consumers in several cases has been lower than predicted in the underlying business models, resulting in network scale being over-stated. Coupled with the rising cost of money this has become a cause of concern for investors. To accurately assess market monetisation and make precise financial projections, it is crucial to consider the varying levels of take rates and the number of subscribers using the network. Failing to do so can lead to misleading assessments and hinder accurate financial projections.

On the other hand, homes activated considers the number of actively connected homes signed up to the network. This metric offers a more accurate representation of revenue-generating potential and market monetisation. Shifting focus to homes activated gives investors a clearer and more holistic understanding of the strength of an AltNet’s brand, network reach and reliability, customer service and ability to generate sustainable returns.

The shift by investors prioritising homes activated over THP correlates to the increasing costs of capital/debt and amount of competition. What started as long-term, utility infrastructure investments, now sees investors looking for their AltNets to show shorter term ROI and demonstrate their ability to attract and retain subscribers. It enables a better assessment of a network's revenue potential by reflecting market demand and consumer adoption rates. Networks concentrating on activated homes can optimise marketing and investment strategies, ensuring improved utilisation and revenue generation. This shift enhances financial viability and appeals to long-term investors seeking tangible returns.

Efficient network infrastructure deployment requires operators to consider several factors, including market monetisation. To achieve this, a focus on homes activated provides operators with an accurate assessment of market penetration. This, in turn, enables them to identify areas that require focus or may be ripe for expansion while minimising infrastructure spend. A targeted approach is crucial for optimising resources and increasing profitability. Moreover, this approach allows operators to pinpoint underperforming areas and implement strategies to boost adoption rates, ultimately driving market monetisation. By leveraging these insights, operators can make informed decisions that ensure the effectiveness of their network deployment while maximising their return on investment.

The significance of homes activated extends beyond immediate financial gains. It aligns with the industry's pursuit of sustainable growth. Emphasising actual network utilisation ensures efficient resource allocation, reducing unnecessary network build-outs, minimising environmental impact, and supporting the development of future-proof infrastructure. Embracing homes activated promotes responsible network expansion and long-term sustainability.

-2.png?width=347&height=221&name=Untitled%20design%20(1)-2.png)

At the recent INCA Investor Workshop, it was reiterated by many attendees that shifting the focus to homes activated as a primary metric is essential for the AltNet community to facilitate accurate financial assessment and market monetisation. Investors are able to better understand revenue potential and network value by prioritising the number of actively connected homes and the forward projections of this KPI. This shift fosters sustainable growth, allows resource (human and manufactured) optimisation, and drives long-term viability. Embracing homes activated as the accurate measure of network success paves the way for a financially sound and environmentally responsible AltNet future.

Unlock the full potential of your network operations and investments with Biarri Networks unparalleled support. With over 10 years of expertise, we have been steadfast partners, guiding operators and investors through every stage of the process. Experience the efficiency of our rapid, cost-optimized designs, enabling faster network deployment at a reduced cost and freeing up resources to attract and retain new customers. Discover how Biarri Networks can propel you towards Homes Activated by contacting Jan, John, and Matt. Together, let's take your network to new heights of success.

Challenge #1: Equipment and material shortages Today's broadband equipment was built for yesterday's approach to building fiber networks. As a...

Bad data has the gravitational pull of Jupiter. It causes problems as massive as a planet for telecommunication networks thanks to errors, missing...

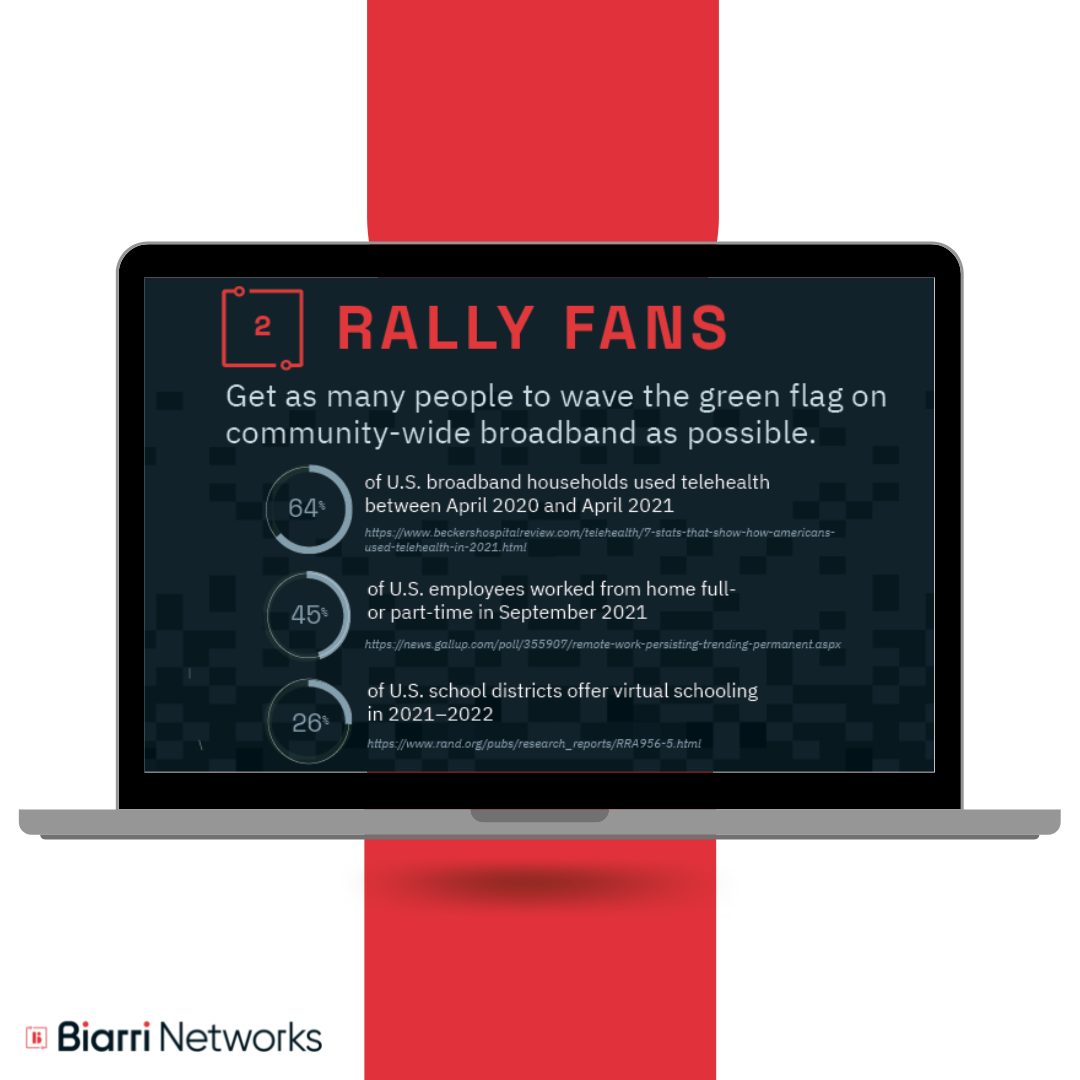

In part one of our series, https://bit.ly/3KJhlYk, we reviewed why broadband access and affordability matters for your community. Now, we’ll explain...